Nike vs. LVMH

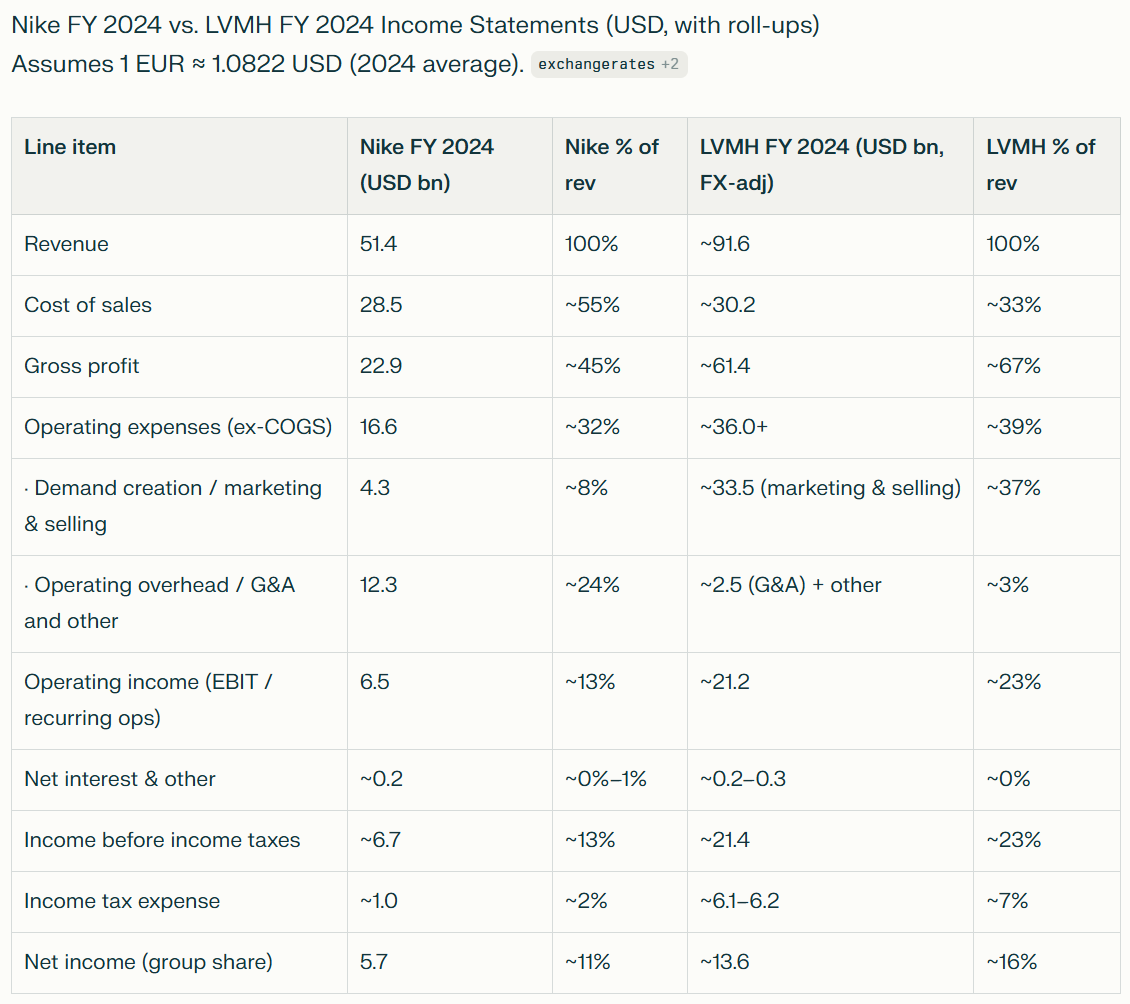

Consider this comparison of Nike & LVMH income statements, side by side, with percentages of revenue broken out.

Two incredible companies doing serious numbers, two completely different strategies behind the business.

Nike:

- Spends more on COGS and books a 45% gross profit margin. Just about flipping a double on costs.

- Includes athlete royalties in COGS, which are estimated around 4% to 5% for top athletes.

- Considers retail costs as operating overhead.

- Nets a 13% bottom line.

LVMH:

- Has an impressive 67% gross profit margin. Which makes sense given the higher prices of its products. There's simply more room for margin.

- Attributes nearly half of cost structure, including inventory, to marketing & selling.

- Considers retail costs as a marketing & selling expense.

- Nets a 23% bottom line.

LVMH made nearly twice as much profit as Nike for every dollar in sales.

Compare the last known quarter for both, and the gap is even wider.

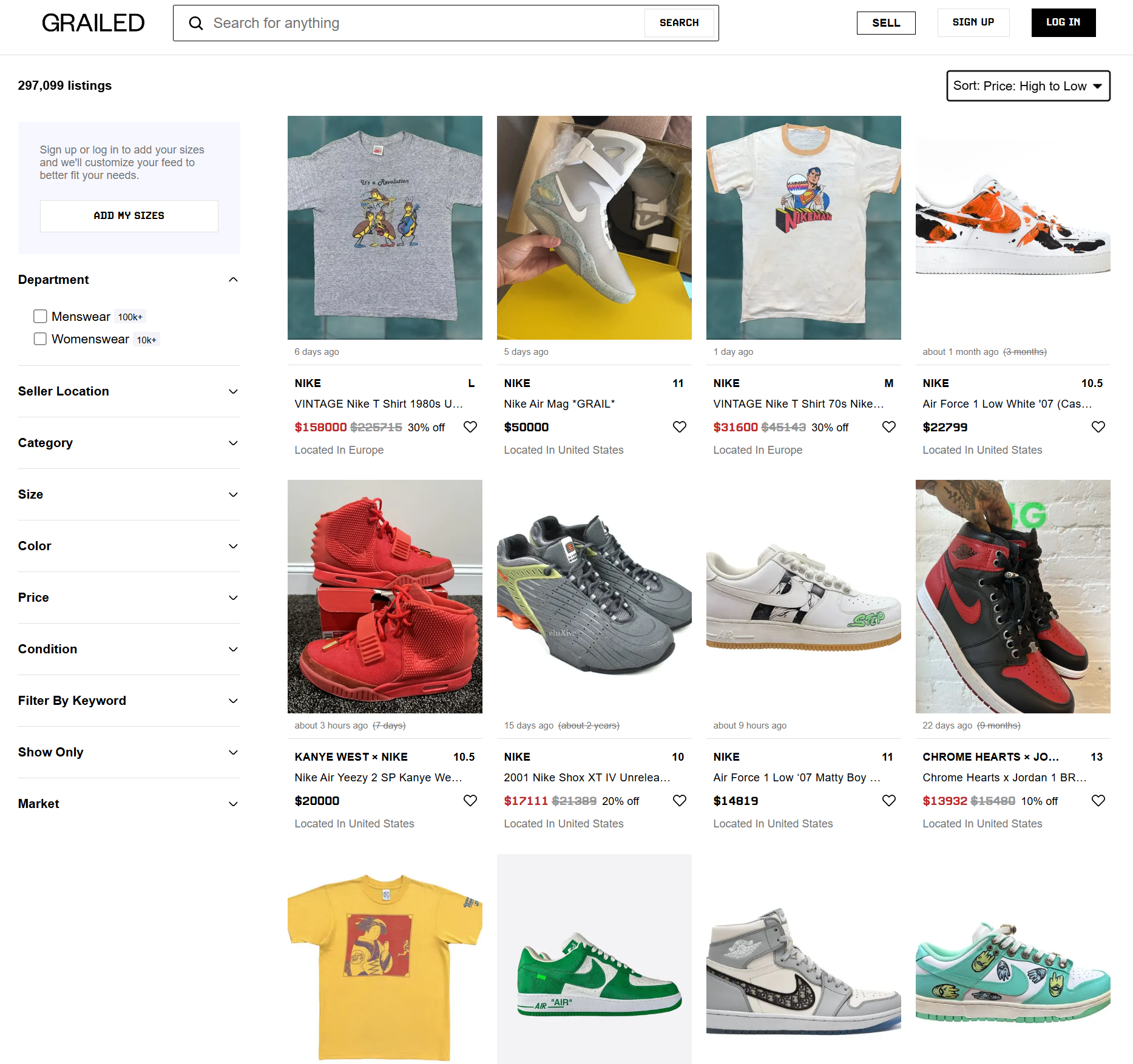

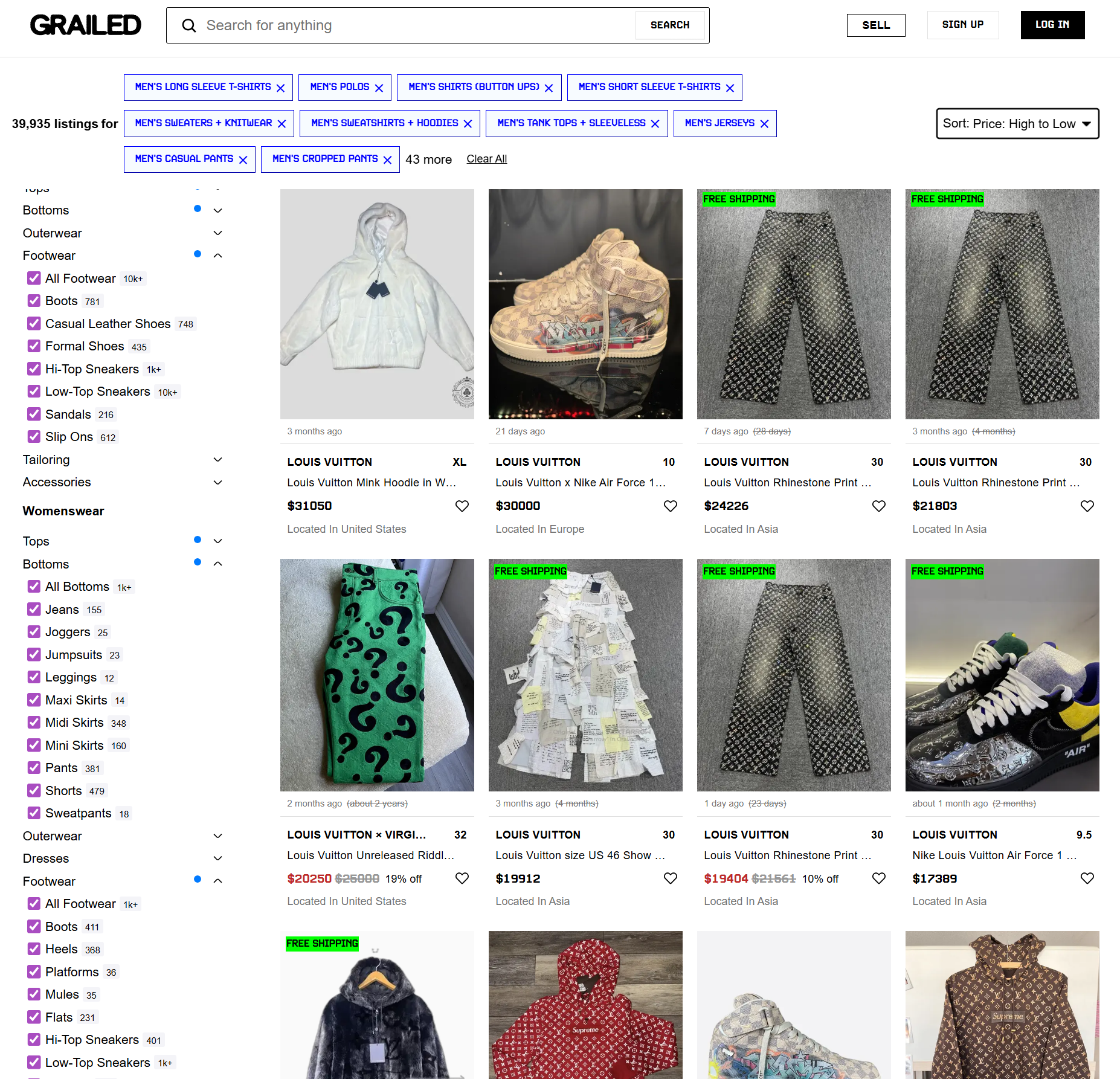

Yet, both companies have shoes and apparel selling for multi 5 figures on the secondary markets:

If Nike has the ability to sell products at the same prices as Louis Vuitton, why are most Nike products in the $100 - $200 range when most LV prices have at least one comma in them?

Why settle for lower bottom line margins?

Is Nike strategically leaving money on the table in underpricing its products relative to market demand?

At the same time, why doesn't LVMH sell lower priced products to capture more of the market?

Surely a subsidiary could eat Nike's market share, if LVMH finds the right brand to acquire.

Revisiting the income statement comparison above, one could come to some conclusions about how each company thinks about their respective business.

Nike:

- Includes athlete royalty costs in COGS. Indicating they think of these costs as necessary component of the product itself.

- Shows high operating overhead costs as an expense. Indicating they think of running the business itself as a major cost.

- Nike marks up their costs, operates retail & distribution infrastructure, and sells products on the other end.

LVMH:

- Shows high gross margin intentionally, to indicate their pricing power.

- Shows high marketing expense intentionally, including store presence, emphasizing that demand creation is their biggest expense.

- LVMH creates demand, picks their price points, and then engages suppliers to produce products that are sold on the other end.

Each company is selling a different dream.

Nike sells greatness and makes margin on the cost of that dream.

LVMH sells status and carves margin from a piece of that dream.